Dwight M Kealy, J.D., MA, CIC, AAI

Does your insured really need Uninsured/Underinsured Motorist (UM/UIM) coverage if they have health insurance? In these difficult times, people are becoming increasingly creative when it comes to cutting costs. One suggestion I heard was to reduce auto insurance costs by eliminating UM/UIM coverage. The person proposed that UM/UIM is unnecessary if someone has health insurance. With over 90% of those in the US now having health insurance coverage, I can see why this suggestion is appealing, but this cost-saving strategy is based on the misunderstanding that UM/UIM and health insurance cover the same things. Health insurance is designed to cover medical bills. UM/UIM coverage is designed to provide coverage the insured wishes an uninsured or underinsured vehicle had to cover their damages.

Although policies vary by carrier, UM/UIM is designed to provide the insured coverage in the event they are in an accident caused by a vehicle that either has no insurance (UM) or has less insurance than is necessary to cover the injuries and/or damages (UIM). A vehicle that commits a “hit-and-run” is also often considered an uninsured vehicle for UM/UIM coverage. State laws vary as to whether there needs to be “visible” proof of the actual “hit-and-run.”

The individuals that are covered by typical UM/UIM endorsements include the insured, the insured’s family members, and any person occupying the insured’s covered vehicle. The damages covered include bodily injury to a covered person. Almost half of states also provide coverage for property damage caused by an uninsured motorist. Some of these states include PD part of the coverage provided and some are elective. In some of the states that allow UM PD, property damage includes damage or destruction of personal property belonging to individuals within the vehicle at the time of the accident. States that provide for UM PM are also split as to whether loss of use of the vehicle is recoverable.

To illustrate the difference between health insurance and UM/UIM coverage, imagine an insured or their family member is in a serious car accident with an uninsured vehicle. If they have health insurance, hopefully their medical bills will be covered. But what if they or their family member requires long-term care, suffers from life-long extreme pain and suffering, is permanently disabled, or dies? These tragedies are not covered by health insurance policies but could be covered under a UM/UIM policy if caused by someone with no insurance, insufficient insurance, or hit-and-run.

Similarly, what if the insured’s business suffers property damage as a result of a car accident caused by someone with no insurance, insufficient insurance, or as a result of a hit-and-run? Imagine the driver hits a power pole that knocks out power to the business for a day, or the insured can’t access their business because the entrance is blocked by police investigators? This may qualify as loss of use of tangible property resulting from an auto accident. This type of incident would have nothing to do with health insurance. While almost all states that provide UM PD would not cover this type of loss, two states, VA and WA, have definitions of “Property Damage” that are broad enough to include situations similar to this.

When the insured is evaluating whether they want to purchase UM/UIM coverage, they may want to understand the odds that they will be in a car accident with an uninsured or underinsured motorist. Let’s start with a look at the likelihood of being injured in a car accident at all—regardless of whether the other driver has sufficient insurance.

• There is an average of six million car accidents in the U.S. every year.

• More than 90 people die in car accidents every day.

• Three million people in the U.S. are injured in car accidents every year.

• Around two million injured in car accidents every year experience permanent injuries.

According to the Insurance Information Institute, there were 40,231 deaths by vehicle accidents in 2017. That corresponds to a one in 103 chance of dying as a result of a vehicle accident.

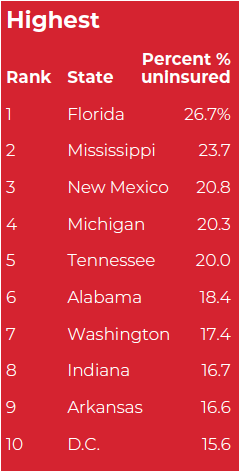

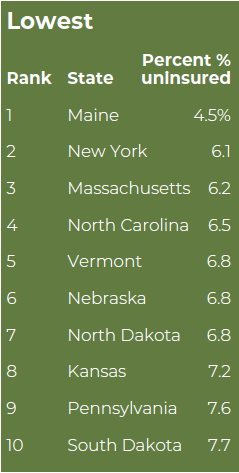

With a glimpse into the likelihood of being in an accident, they may want to know the likelihood of being in an accident with an uninsured motorist. This largely depends on where they live. The adjacent charts show the Insurance Information Institute’s 2015 list of the “Top 10 Highest and Lowest States by Estimated Percentage of Uninsured Motorists.” As you can see, if they’re in a car accident in Florida, there’s greater than a one-in-four chance that the other driver has no insurance at all.

Underinsured Motorists

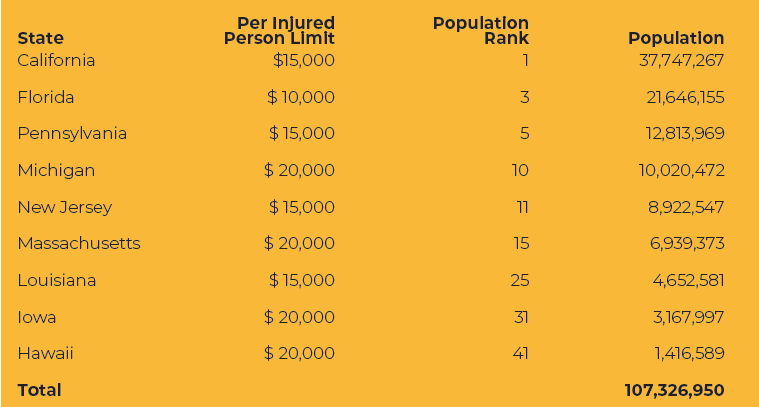

Even if the driver has insurance, there is a question as to whether the driver has enough insurance. Every state has a minimum auto insurance liability limit. However, one-third of the U.S. population lives in states where the required per person auto liability limit is less than the average cost for an inpatient stay at a hospital in the USA.

A study funded by the Bill and Melinda Gates Foundation that was published in the January 2019 issue of a public health journal found that the average cost for an inpatient stay at a hospital in the US in 2016 was $22,543.

Compare this with the minimum per person bodily injury liability limit of $15,000 in California, Pennsylvania, New Jersey, and Louisiana; and $20,000 in Michigan, Massachusetts, Iowa, and Hawaii. In Florida, the minimum auto liability limit for bodily injury per person is $10,000. This means that even if the insured is in an accident with someone who has insurance, in many cases, the insurance the other driver carries will be insufficient to pay for the average inpatient stay at a hospital.

The danger of using an example including medical bills is that it risks reinforcing the belief that UM/UIM is unnecessary for those who have health insurance. It is true that if they have perfect health insurance that covers all of the bills of the hospital stay, they and their caregivers do not miss any work or experience any loss of income, and they do not experience any pain and suffering or die, the perfect health insurance in this perfect situation may have provided enough coverage.

Unfortunately, there are no perfect accident scenarios. A recent study found that 66.5% of personal bankruptcies cited medical issues as the reason for the bankruptcy. Of these, 88% (58.5% of total bankruptcies) were specifically caused by medical bills. The remainder were caused by those who had to take time off of work and were not getting paid due to medical issues.

With UIM coverage, they can give themselves the coverage they wish the other driver had.

Another danger of writing this article, as an insurance professional who also happens to be an attorney, is that I’ve heard people say that the only people who insist on others buying UM/UIM coverage are attorneys because attorneys want to go after the policies to get paid. It is true that most plaintiff attorneys get paid based on the amount that they are able to recover. If the attorney is able to help an injured party recover a larger amount, the attorney will get paid a larger amount. The typical fee for a car accident often ranges between 25% and 40% of the amount recovered. To this end, if they want to ensure that no attorney gets paid a large amount in the event that they or a loved one dies or is permanently disabled in a horrible car accident by an uninsured, financially insolvent driver, they could avoid purchasing a UM/UIM policy. This way, in a 1/3 contingency fee situation, instead of an attorney receiving $100,000 and the family receiving $200,000, they can ensure that both you and the attorney will receive nothing. This will also ensure that no one receives compensation for the pain and suffering from injuries to or loss of a loved one.

When deciding on whether or not to purchase UM/UIM coverage, ask the insured if they would want coverage in case they are in an accident with an uninsured or underinsured motorist that causes them or someone in their household to miss work, causes significant pain and suffering, causes a permanent life-altering disability, death, or property damage. This is what a UM/UIM policy is designed to cover. The cost of UM/UIM is minimal when broken down. For example, if the annual cost of the coverage is $500, that equates to less than $10 per week. Most people spend that much just on the cost of lunch! If they’re relying on health insurance, they most likely will have no coverage and the cost will be significantly higher.

About the Author: Dwight M. Kealy, J.D., MA, CIC, AAI

Dwight Kealy is an insurance attorney, expert witness, author of several books on insurance, and Professor of Law in the College of Business at New Mexico State University where students can earn a minor in Risk Management and Insurance. He received his CIC designation in 2007 and has been a faculty member with The National Alliance since 2011.