The Insurance Services Office (ISO) HO 22 Updates Livestream event featured a discussion between Dustyne Bryant, CIC, CISR, MBA, Academic Director for Personal Lines, and Paul Martin, CPCU, Director of Academic Content, about the changes to the Insurance Services Office 2022 Homeowners edition. It outlines the benefits and drawbacks of the upcoming changes and highlights ISO’s introduction of the new HO 00 14 coverage form. The discussion is a great way to prepare for what is coming next year and is a valuable education resource for any producer, account manager, or underwriter working in personal lines.

Learn more in the CISR Insuring Personal Residential Property course!

Mitch Dunford (03:07): Welcome to this National Alliance YouTube live stream event. I’m your host, Mitch Dunford, and we’re super excited to share this program with you. If you’d like to submit a question during the event, just make sure you’re logged into YouTube, your own YouTube account, and then type the question in the chatbox on the lower right-hand side of the screen. The topic for today’s event is the pending changes ISO is making to the homeowner’s HO 2020 form expected to roll out in Q1 of 2022.

Mitch Dunford (03:42): To help us understand the specifics of these ISO revisions, we’re delighted to have two of our National Alliance academic directors with us on the event today: Dustyne Bryant and Paul Martin. Welcome, you guys. It’s great to have you.

Paul Martin (03:57): Thanks, Mitch.

Dustyne Bryant (03:58): Thanks so much! I’m so happy to be here.

Mitch Dunford (04:02): So Dustyne is our Personal Lines Academic Director and host of our popular Awkward Insurance podcast. So Dustyne, tell our audience a little bit about yourself.

Dustyne Bryant (04:13): Oh, sure, Mitch. Well, I’ve been in insurance for about 15 years, mostly on the independent agency side. And now I am the Personal Lines Academic Director at the National Alliance, which means I get to do fun things like host Awkward Insurance. So maybe you’ll get a little bit of a taste of that today because I’m sure something will come out of my mouth that is slightly or all the way awkward.

Mitch Dunford (04:34): It is awkward.

Dustyne Bryant (04:36): But I spend most of my time at that National Alliance reviewing amazing policy language, helping others understand it, as well as gaining a greater understanding of the policy language from others. And I’m enjoying every second of it and so happy to be here discussing this topic with everyone today.

Mitch Dunford (04:55): Awesome. Thanks, Dustyne. It’s great to have you here. So, Paul Martin is the Director of Academic Content here at the National Alliance. He’s been an insurance educator for, what, 30 years, Paul? You’ve been around a long time. So tell our audience a little bit about yourself.

Paul Martin (05:10): Sure. I got into insurance right out of college, and I’ve been really blessed to do a lot of different things in insurance, working for companies and agencies. I was a claims adjuster. I was an underwriter at a company in the Southeast, or in Alabama. I became a partner in an independent agency in Mississippi. I got around with all the accents, as you can tell and worked for a large insurance company in Texas for a while before being part of the Independent Agents Association in Texas where I was their director of education for many years. I’ve gotten to work with some tech startup stuff in the insurance field, and I’ve been with National Alliance now a couple of years and absolutely love getting to work with super talented people like Dustyne, and it’s a real fun job. If you’re making a difference in people’s lives through education, then that’s what really makes it fun.

Mitch Dunford (06:01): Absolutely. All right.

Dustyne Bryant (06:03): I so agree with that.

Mitch Dunford (06:07): All right. So without any further ado, Paul, let me turn the time over to you and Dustyne to make the presentation.

Paul Martin (06:13): Thank you, Mitch. Well, one of the things, reasons we’re doing this is most of the audience knows, the Insurance Services Office from time to time makes revisions to its various programs whether it’s personal lines or commercial lines, they’ll put out a new CGL policy or they’ll put out a new batch of property endorsements, and the changes that they make on the forms, sometimes they’re a big deal. Sometimes it’s not that big a deal. Sometimes it’s an improvement. Sometimes they’re carving out coverage because something happened in the courts or maybe there’s a new trend like we’ve seen with Hovercraft and that kind of thing. That’s relatively new. So they made some changes over the years.

Paul Martin (06:52): We’ve certainly seen out of the commercial side with pollution issues and all kinds of things like that. But ISO is coming out with a new homeowners form that’s going to go into effect next March. This is again a reminder for those of you that may not know how this works. The insurance companies can take it or not. They can choose to use older forms if they want to, but a lot, a lot of insurance companies will take the latest forms that ISO uses in personal lines, like in auto and homeowners. So they’ve got this new homeowners filing, and it’s a pretty big filing. Dustyne and I will talk about some of these things, but some of the changes are really interesting. There are some drawbacks to some of it, and we’re going to talk about those details.

Paul Martin (07:40): But the most exciting thing besides new endorsements and the new format that’s come out for the standard ISO 3, is we actually have a brand new type of homeowner’s policy. Don’t we, Dustyne?

Dustyne Bryant (07:53): We do! It’s so exciting. I don’t know about you guys, but any time I’ve ever gotten my hands on a new form or a new endorsement or another carrier’s policy from a prospect coming in and showing it to me, I’ve always gotten excited. So this new release from ISO is just super exciting to me. It’s like reading a whole new form. Well, it is like reading a whole new form because it is. So ISO is introducing the HO14 or the Home Owner’s 14 contents comprehensive form, which is a beautiful marriage between the HO4 and the HO5. So the HO4 being the contents broad form and the HO5 being the comprehensive form, and now we just have this beautiful HO14 contents comprehensive form.

Paul Martin (08:43): Why do you think they did it?

Dustyne Bryant (08:45): Oh gosh. So according to ISO, they conducted a survey on millennials. I want to say it was in 2018, but out of this survey… Oh, let me mention it as well. It’s called the ISO Millennials Attitudes and Usage Survey. And they used it to help develop this form. From that survey, they found that 55% of those who needed renter’s coverage did not have it. And among those reasons were, the most common that we get is agents when we’re trying to pitch this to younger folks in particular. It’s because they think they either don’t need it, it’s too expensive, which we know it’s not that expensive.

Paul Martin (09:26): It’s not that expensive.

Dustyne Bryant (09:29): Or that it’s not important. A lot of times, I’ve found, being in the independent agency world, is that people think it’s not important because they don’t really want to insure their stuff. They’re like, “Ah, it’s just miscellaneous stuff that my parents gave to me.” But they’re forgetting the all important liability coverage that comes with it so they don’t fully understand the importance of the renter’s form. So this survey was conducted, I want to say off the top of my head, it was somewhere around six to 800 millennials asking them why they wanted coverage or didn’t have coverage and what was most important to them, and out came the HO14.

Paul Martin (10:11): There you go. In fact, when you look at the coverage itself, I was trying to divine… Because they did some strange things to it, didn’t they? I mean, it looks like it’s designed for somebody that lives in an urban environment that might rent out their house from time to time, their apartment from time to time. Did you get that impression?

Dustyne Bryant (10:31): It does look that way because one of the most differentiating factors of the HO14 is that it is adding in included coverage for home-sharing host activities. Now, we’ll talk about that a little bit later that ISO pulled that language out of an endorsement form that is already there called the Home Sharing Host Activities Endorsement Form, and they’ve included it in homeowner’s policies now to exclude that coverage. But this form, the HO14, incorporates coverage.

Paul Martin (11:03): Actually includes it.

Dustyne Bryant (11:04): Yes. So it is different from all of the other homeowner policy forms right now.

Paul Martin (11:09): So it’s not necessarily for everybody because it’s got some drawbacks.

Dustyne Bryant (11:14): It does. There are benefits and drawbacks to the HO14. So if you’re thinking, “Ooh, this is the new and improved renter’s policy. I can’t wait for my carrier to adopt it and be able to offer it.” Just have a little bit of caution and make sure that you understand what your client needs because there are going to be benefits to both forms. So another difference between the HO4 and the HO14, as we’ve already said, is its comprehensive coverage. So you have open perils on your coverage, but you also have replacement cost on your losses. Whereas, the HO4 is the actual cash value and name peril unless you endorse those coverages specifically to the HO4.

Dustyne Bryant (11:58): So some of the benefits of the HO14 is, like I said, the open peril and replacement cost on property. There’s an interesting little tweak to special limits. We’re used to seeing sub-limits for certain classes of property, a specific dollar amount, but the HO14 has those special limits at 10% of coverage C or personal property. So that’s a little different and kind of interesting because it can provide both either higher or lower coverage depending on how much coverage you’ve written. And then, of course, the added home sharing coverage that comes with that.

Dustyne Bryant (12:37): We’re also seeing an additional benefit for bed bug coverage.

Paul Martin (12:42): There you go.

Dustyne Bryant (12:43): Yeah, which kind of goes along with renting your apartment out. Excuse me. But be careful with that one because it’s on a per policy period. It’s not per occurrence. As well, there’s also an added coverage for hard drive recovery. Again, I believe it’s $500 for the policy period not per loss. And then, loss of rental value is going to be included with the home sharing host activities.

Dustyne Bryant (13:12): Now let’s take a look at the drawbacks because this is where you’re going to want to be careful that your insured might still be doing activities that are covered under the HO4 but not covered under the HO14. So the definition to insured location is slightly narrower.

Paul Martin (13:28): It is.

Dustyne Bryant (13:29): Yes. You’re not going to have… An insured location is not going to be vacant land like it has been before. So if they have this rented apartment, and they’ve decided that they’re ready to start building a home and they go out and purchase some vacant land, it is not an insured location. You’re going to need to look for an endorsement for that and be cognizant of it in case your client is moving in that direction. There’s no cemetery plots, which hasn’t generally been largely important to anybody. So you’re not missing much there. And then, let’s see, you’re also going to have property not covered. There are some changes there.

Dustyne Bryant (14:10): So motor vehicles are not covered for either property or liability. So on property, you’re going to have a little bit of coverage for those only if they’re designed for the handicapped and not required to be registered on public roads.

Paul Martin (14:30): So you don’t need coverage for your riding lawn mower, for example.

Dustyne Bryant (14:33): You sure don’t. So if you are renting a home and using this HO14 and mowing your lawn, that’s not going to work out well for you. So the HO14 is going to be better in that aspect for apartment renters or renters who are renting an actual site-built residence. There’s also no liability coverage for watercraft. None.

Paul Martin (14:57): Isn’t that weird? Isn’t that strange? That’s strange.

Dustyne Bryant (15:00): Right! I think it’s a little strange, too because I might rent an apartment and go out to the beach and decide to rent a watercraft, and now I don’t have any coverage if I have an HO14. So be aware of that when you’re selecting a form like this for your client as well.

Paul Martin (15:19): That’s a good summary of what this new form is. And again, I know it’s really early. We’re nine months out from this thing going into effect, but one of the things we know, because we’ve been insurance agents, we just understand when a new form’s coming and you don’t know what the changes are, you feel awkward and a little bit defensive and uncertain because you’re going to have renewals coming up in March. And if they’re going with the new form, you need to be educating the customer about the changes and the opportunities because there’s some really good stuff that we’re going to talk about next.

Dustyne Bryant (15:51): Not only that, but what if you’re competing with another agent who’s carrier has adopted these forms, and your carrier hasn’t, and your client comes to you saying, “Oh, my…”

Paul Martin (16:01): What’s the difference? Yeah.

Dustyne Bryant (16:01): Right. They’ve proposed an HO14. Don’t know what that means because they probably won’t say it that way, but they’ve proposed an HO14, and my new agent says it’s so much better. If you don’t know what that means, you’re not going to be able to counteract it.

Paul Martin (16:14): Right. And we also wanted to do this event today because it’ll be recorded, and it’ll be available. As we get closer, this can be the kind of resource that you can refer friends and your agency colleagues, too, or even at a company. You can say, “I’m not aware of it.” So you can use it for training or educating your folks. It’s not meant to be completely comprehensive of every change in the form. But be aware, at National Alliance, I know, Dustyne, even now we are incorporating these into our programs.

Dustyne Bryant (16:44): Yes, we are. We’re starting with the CISR insuring personal residential curriculum and incorporating some of these changes on a very high level so that at least participants are going to be aware of what’s out there even if their carriers don’t offer these options.

Paul Martin (16:59): That’s right. All right, now. Of course, they also changed the form we sell every day, the HO3, the most sold policy in the world, I think. And Dustyne, let’s start off with they made a format change. Now, this is really interesting. Tell us about the format change and how it’s going to look different.

Dustyne Bryant (17:17): So the most exciting change to me other than policy language is that we are now going to be looking at a policy form that reads one column top to bottom. They’re getting rid of… ISO is getting rid of that double column where you have to read down this side and then go back up to the other side and read down it again and heaven forbid, you’re on an electronic document, and you’ve got to switch down to another page. It’s just awkward and cumbersome and a little difficult. So now it’s going to be easier to read for both the agent and the client because you just read top to bottom like you would any other text book or book or good bathtub read.

Paul Martin (17:56): And I don’t know the exact reason when folks at ISO said, “You know what? Need to make this change.” But some of you might not be aware, there are working groups within the Insurance Services Office that are practitioners. They’re agents and company folks, and they form these working group sub-committees. They even have a conference in St. Louis, and they discuss all this stuff. And they’ve been talking about this, obviously, for years because it’s a big change in formatting, but that’s just formatting. Policy will look different. So get ready for that.

Dustyne Bryant (18:26): I kind of imagine it like this. You know how they say four out of five dentists recommend a certain toothpaste?

Paul Martin (18:31): Yeah.

Dustyne Bryant (18:32): I bet it was like four out of five insurance agents recommend having a single flow format. But who’s that one that was like, “No. Let’s keep the double columns.”

Paul Martin (18:42): It was always that double justified, two column thing.

Dustyne Bryant (18:45): It hung around way too long.

Paul Martin (18:48): And I even laugh because it’s kind of like the Bible. It had to be like the Bible, you have two columns.

Dustyne Bryant (18:53): This is true. I never thought of it that way.

Paul Martin (18:55): Yeah. I don’t know why, but anyway, that’s going away. Let’s talk about some of the things that have changed. For example, there’s some changes to the weed. I mean, cannabis. What are some of the new things that are happening?

Dustyne Bryant (19:06): So in the homeowner’s policy forms, you’re going to see added definition for cannabis, and the whole purpose to that is because, as you know, throughout the nation, there are varying laws and degrees of those laws about whether or not cannabis, whether it’s medical or recreational use is legal, and even if it’s legal in the state, there’s still some question whether or not it’s legal on the federal side. So there are exclusions in the policy already under liability that relate to drug use and all that goes with that. But now that it’s becoming so prevalent for cannabis to be used, there are also some claims happening where what if there’s a loss to cannabis? Is this a plant? Is this something that’s considered property? So they have gone ahead and…

Paul Martin (19:55): Seriously, is somebody going to say, “I’ve got $5,000 worth of weed in my house. Can I insure that?” I mean, I guess they might. I don’t know.

Dustyne Bryant (20:04): Yeah. So they’ve added a definition so that they can go ahead and call it property not covered. You’re going to have to get an extra endorsement in order to get limited coverage because they’re not giving you an infinite amount but limited coverage for damage to your cannabis as well as another endorsement for adding liability for the use of or even growing because some states are allowing personal use growth of that. But it’s just whether or not your carrier’s going to adopt it.

Paul Martin (20:36): This is a serious issue. It’s kind of a hard conversation probably to have with some people, but if you’re the family that tokes together kind of thing, the liability side of this could be serious. I mean, it’s not any different than host liquor. You could be held liable for over-serving to friends.

Dustyne Bryant (20:55): Yeah, yeah. That was the whole point to it. Mm-hmm (affirmative).

Paul Martin (20:58): So anyway, that’s an interesting change they made is that.

Dustyne Bryant (21:02): Yeah, I can imagine, though, it’s not going to be one of these $10 endorsements if your carrier does offer it because that’s…

Paul Martin (21:09): If they’ll offer it. That’s another point that we need to make.

Dustyne Bryant (21:11): Right.

Paul Martin (21:12): It might be available, but they might say, “No. We’re not doing that.”

Dustyne Bryant (21:15): Yeah. So intentional damage is still going to be excluded. So lighting it up isn’t going to be a covered fire loss.

Paul Martin (21:23): Have they made another big definition change, didn’t they, about the home sharing or something?

Dustyne Bryant (21:28): They did. So they added a few definitions around home sharing host activities. You’re going to see home sharing host activities as well as home sharing occupant and home sharing network platform, which many of us are very familiar with on the auto side where you see transportation network platform. And this is going to be used in a very similar way so that that coverage is later excluded in the policy and just like cannabis, you are now going to need to purchase an additional endorsement in order to add both property coverage and liability coverage back for that exposure for home sharing host activities.

Paul Martin (22:08): Cool. Well, I know that they made some changes, too, to the sub-limits and things like that.

Dustyne Bryant (22:16): They did. So if we could take a look at the…

Paul Martin (22:19): At the table.

Dustyne Bryant (22:19): Yes, at the special limits chart. So like we mentioned before, the HO14 now has all of these not even stated, but they are included in a 10% of coverage C. So we’re used to, as agents, seeing these additional limits, and you may be used to getting a cheat sheet from your insurance carrier that lists all of these additional limits and whatnot. Well, now ISO has updated some of the limits. You’ll notice for the most part that where there was coverage up to $1500 you’ll now see around $2,000. For $2500, you’ll now see around $3,000. And then we are going to have an added class, which is now going to limit coverage for model or hobby aircraft. Previously, you might have had coverage under coverage C for that without a limit, but now it’s going to have a sub-limit.

Paul Martin (23:17): Now, the limits changes, guys, as you can see, it’s not a big deal, and they’re going up. So I don’t really feel a big E&O concern there.

Dustyne Bryant (23:25): No. Again, it’s just for incidental stuff. This is not meant to be like, “Oh, dude. You’re covered for your extensive firearm collection.” No, this is just for when somebody goes down the street and purchases an extra firearm or a new firearm and brings it home and they don’t even think to call their agent about it. It’s incidental coverage, basically.

Paul Martin (23:43): Right. So we also have some other changes. What are some of the other additional coverage changes we have?

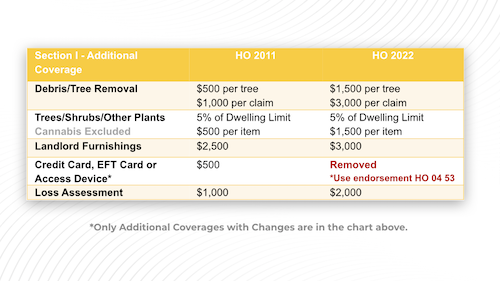

Dustyne Bryant (23:49): Yeah. So under the additional coverages of section one, you’re going to notice increased coverage for debris and tree removal. You will notice that the amount per tree has been increased because we all know that at the time of a loss, when that tree comes down, it’s more than $500, especially at the time of a weather loss. Those tree companies get out there, and they make some money for that. So you’re going to have some higher coverage per tree for debris removal as well as loss to those trees, shrubs, or other plants. You’re going to see that $500 per item increase to $1500, and notice that cannabis is excluded as a covered plant. So that’s why they added the definition of cannabis there. Landlord furnishings. You’re going to get a little bit higher limit for that. Credit card and EFT coverage, that’s never been used in the past really because credit card companies have done such a wonderful job of taking care of that and the fraudulent activities. That’s completely removed from the homeowner policy now, and if you want to have it, there’s an endorsement out there for it now, but I can’t see that that endorsement’s hardly going to be used.

Dustyne Bryant (24:58): And then loss assessment coverage for your condo owners or your property owners that are part of a POA or HOA. You’re going to have an increased amount, $2,000 for that, and that’s under both property coverage and liability. You’ll have that increase for loss assessment.

Paul Martin (25:14): Good. That’s a good summary. And again, folks, this isn’t one of those things that again I think is a big E&O issue. You’re seeing slight increases again.

Dustyne Bryant (25:23): Yeah. Let me detour for just a second to the HO14. This is one of those situations where the HO14 is different from all of the other policy languages. Under additional coverages, all of the other policy forms have 11 additional coverages. The HO14 only has four additional coverages. So that’s going to be one of the differences between the HO4 and the HO14. The HO14 has debris removal, reasonable repairs, hard drive data recovery and that bed bug remediation.

Paul Martin (25:56): Okay. So again, that HO14 is not for everybody. It’s going to be things you want to get to know well, but also explain well and educate your customers well.

Dustyne Bryant (26:06): You got it.

Paul Martin (26:06): Okay, so let’s move to liability. What are some of the changes in the liability coverage in the standard HO3?

Dustyne Bryant (26:12): You got it. So damage of property to others, we’re increasing that amount, too. Not we, ISO is. ISO’s increasing that amount from $1,000 to $5,000. That’s really going to help for those incidental issues that pop up where damage has occurred to somebody else’s property. So there’s not a lot that can be covered under $1,000 these days.

Paul Martin (26:33): No.

Dustyne Bryant (26:33): That was a much-needed increase, right? You’re also going to see riding lawn mowers is clarified. So there was just a little bit of a hiccup in terms of how riding lawn mowers may or may not have been covered, and now it’s specifically stated that if you are using that riding lawnmower to mow a lawn, doesn’t matter who’s lawn, then you’re going to have liability coverage for that.

Paul Martin (26:57): That never made sense anyway, did it. The old way. Wait a minute, I can’t take my lawnmower across the street and mow that poor old lady’s yard.

Dustyne Bryant (27:05): Yes. At one point, it said if you’re using it to maybe, on your residence premises, and then the next change said on a residence premises, or on a premises or of a residence. I’m sorry, I don’t have the exact terminology pulled up, but it tweaked it to make it a little bit broader. And I guess that just wasn’t enough that it was still being disputed in courts. So they’re like, “All right, fine. We’ll make it so specific to say you can have your riding lawn mower on any lawn as long as you’re mowing that lawn.”

Paul Martin (27:33): Well, I know this sounds crazy, but who do you think mows the grass at a VFW Hall or at some Lutheran church? Well, the members do. They bring their lawnmower down there and they cut the grass on Saturday or whatever.

Dustyne Bryant (27:47): Yeah.

Paul Martin (27:47): So yeah, it’s a good change. That’s a good change.

Dustyne Bryant (27:49): And then like we’ve already noticed or already stated because we are now defining home-sharing host activities and home-sharing occupants, we’re adding some exclusions for that, or ISO is adding some exclusions for that. So there’s going to be an exclusion under med pay to others for the home sharing occupant and their guests. So if they have anybody that comes on, they’re going to be excluded from med pay to others as well. Exclusions for cannabis liability. You can add it back if your carrier lets you. And then exclusions for home sharing host activities under liability as well.

Paul Martin (28:23): All right. Now, the next thing I want to talk about is funny because I just have these vivid memories of back when I first got into insurance. And these stupid boat things, the outboard, 25 horsepower, outboard motor, and then inboard or outdrive.

Dustyne Bryant (28:41): Inboard to outboard, outboard, inboard, jet drive, this drive, everybody drive. It was always confusing, and one of my most hated seasons as an agent was boat season. I hated writing boats and not because boats were difficult to write but just because it was so hard to get the right information from the client. They call you and they’re so excited and they’ve purchased a boat and asking them to give you a hull number. And they’re like, “A what number?” So you can’t get the hull number, but then you’re like, “Well, is it an inboard? Is it an inboard-outboard, and outboard?” And they’re like, “I’m sorry, what now? It has a motor on it.” “So is it 40 horsepower, 50 horsepower?” “I don’t know! It drives!”

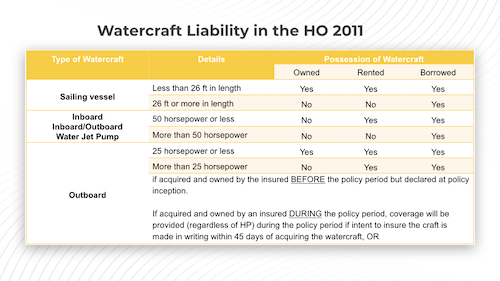

Dustyne Bryant (29:23): So it was always so hard to get the information to get the quote even started. And it was a pain in the butt, and I hated it. But ISO has made a huge improvement in this area. And if we could bring up the chart for how watercraft are currently covered. So you will see that we’ve got classifications again for inboard, inboard-outboard and water jet pump, whether it’s 50 horsepower, 25 horsepower determines whether or not you have coverage for owning one, renting one or borrowing one. As we’ve always said in the past, you see in that column for borrowed, it was always best to borrow your buddy’s boat because then you don’t have to worry about where the liability is coming from and if you’re covered or not.

Paul Martin (30:09): That’s right.

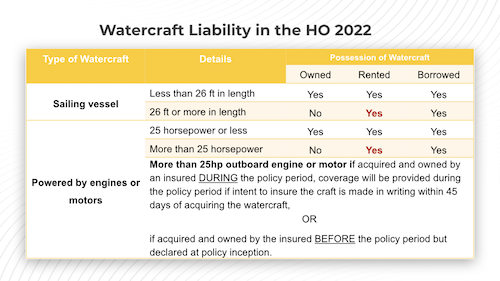

Dustyne Bryant (30:11): But the HO 2022 ISO has made some really awesome tweaks to that if we can pull up that chart next. Not as many lines to cover here, and the red yeses are where there used to be nos. So now there is going to be coverage for… And notice, first on the, what is this, the left-hand column.

Paul Martin (30:34): They don’t make a distinction between type and motor anymore.

Dustyne Bryant (30:36): No inboard, no inboard-outboard, no outboard, no jet drive, no nothing! It’s just powered by engines or motors. So that is totally awesome. You don’t have to ask that question as frequently anymore. I’m sure your carriers might keep it around for some reason or another. But now it’s just powered by engines or motors, and then there’s the 25 horsepower that you only have to worry about. 25 horsepower less, you are covered for own, rented and borrowed. 25 horsepower or more, you are now covered for renting a boat. So go out to the beach.

Paul Martin (31:08): And that wasn’t true. That wasn’t true before.

Dustyne Bryant (31:11): Right. Go out to the beach, and rent that twin engine boat and just take off into the sunset because now you have liability coverage under your homeowner policy for it, and you don’t have to worry, not that you worried before because you were probably just interested in getting in that boat.

Paul Martin (31:27): This has always been one of those things because my wife actually years ago, she said, “Hey, can we rent some wave runners?” We were in Destin or somewhere. My reaction was, “No.” That’s when it really kind of sucked to be an insurance guy because I know that’s not covered [inaudible 00:31:45] and now…

Dustyne Bryant (31:46): Can’t you just walk up to the owner and say, “We’ll borrow these. We won’t take them.”

Paul Martin (31:49): Yeah, can I just borrow it. Slip him a 20, let him borrow it.

Dustyne Bryant (31:52): Right. So the only place you’re going to see a classification on the motor now is on a newly acquired boat. So outboard engines, 25 horsepower or more are going to be automatically covered under your homeowner policy if you acquire them within the policy period. So you will have coverage for that, just make sure that you use that time to go ahead and get the proper watercraft coverage before that policy term expires.

Paul Martin (32:20): There you go.

Dustyne Bryant (32:21): And make it writing, apparently. Make your requests known in writing.

Paul Martin (32:27): Oh, that’s funny. Okay, what are we missing. Anything?

Dustyne Bryant (32:32): There are some endorsements under the new revision. So this form or the release that ISO sent out in their circular had over 700 pages, and it seemed a little daunting at first until I just realized that that super exciting change from double column format to one single page corrected all of the policy forms and endorsements that are underneath the homeowner program. So all of those were included in the circular release. It was really fun. That was a lot of fun to look through that document before I realized that. Excuse me. So we’ve got some endorsements. In the past, we have had other structures away from the resident’s premises, but the loss valuation on that was ACV. Now we’ve got the added option for replacement cost for those other structures away from the resident’s premises.

Dustyne Bryant (33:21): Again, the broaden home-sharing host activities for both properties, that endorsement is going to include some coverage for property that’s in that location that you are renting on a home-sharing network platform as well as a liability for doing that as well. It’s going to be included under the broadened home-sharing host activities endorsement. We’ve got an added bonus on water sump pump backup. Currently, ISO has a limited water sump pump backup, which means that the backup needs to occur in the dwelling in order for that backup to be covered.

Paul Martin (34:03): It has to be your water.

Dustyne Bryant (34:04): Yes. Yes. Well, the broadened form, the added broadened form now says it doesn’t matter if that backup occurs in the dwelling or outside of the dwelling, it’s going to be covered if you have a water damage loss related to water backup or sump pump discharge or overflow. Incidental low-powered recreational. I’m a little excited about this one. In the homeowner policy, you have some restrictions on the recreational vehicles, and one of the exceptions is for your child who has the little power wheel, the Barbie power wheel and you can operate it off the resident’s premises and have coverage for that because it’s made for a child under the age of, I think it’s five, and under five miles per hour, but my kids are getting older. And we have electric scooters. So they go well over five miles an hour. They are no longer under five years old. And those don’t have coverage when you own them and you’re off the resident’s premises.

Dustyne Bryant (35:02): So you could’ve added the incidental low powered recreational vehicle policy to your policy to try to get some of that coverage back, but there were still exclusions for those e-scooters. Well, that’s not on the form anymore! So now there’s coverage for the e-scooters that your kids maybe have, and even the electric bicycles that my older child would like because she hates peddling the bike.

Paul Martin (35:27): Now, this is an endorsement, correct?

Dustyne Bryant (35:30): It is. It’s an endorsement. Yes.

Paul Martin (35:32): Because I actually took a trip a couple of years ago. We did the electric bike thing. It was out in California. I thought it was the funnest thing in the world because it’s so easy. But only later, I went, “Oh, I don’t get any coverage for that on my home owner’s.” So now I can get it if that’s something you want to buy an electric bike, you got a solution now.

Dustyne Bryant (35:50): You got it. And then the last few, the cannabis that we’ve already mentioned, you can get up to $5,000 for property damage to your cannabis plants if your carrier offers it, and the liability coverage related to the use or growing of cannabis as well as something that kind of slipped under the radar last year, ISO now has a standard form for utility line expense coverage. So they caught up to that. Many insurance carriers were already offering a version of that, but now there is a standard endorsement form to use for that.

Paul Martin (36:25): This is another thing that may be worth comment. You know this is an issue because private water companies now, offer this coverage.

Dustyne Bryant (36:35): They do! Yeah!

Paul Martin (36:37): They nag you about it a lot, and they say it’s your lateral line. If folks don’t know what that is, the line that runs from your house to the mainline, if that bad boy breaks, not only do you get a really big water bill, but it can be kind of expensive to fix. So it’s meant to address that issue. I think, really, that’s older homes have more vulnerability if they just use PVC or something a long time ago.

Dustyne Bryant (37:03): It could.

Paul Martin (37:03): Because I’ve had them break on me before.

Dustyne Bryant (37:08): Yes. So great way to sell that. We had carriers that offered that when I was on the independent agency side. We would get those calls. “I just got a notice from my utility line company asking if I want to purchase this coverage or whatever.” I’m like, “Well, you’ve actually already got it under your homeowner policy. We added that for you.” “Well, why do I need to pay for that?” “Well, do you want to squabble with the utility line company over whether or not they’re going to pay for it or you’re going to pay for it, or would you like somebody in your corner who can help you walk through that claims process?”

Paul Martin (37:41): There you go.

Dustyne Bryant (37:42): Yeah, little difference there, but yep. It’s offered now.

Paul Martin (37:46): Well, thanks, Dustyne. We didn’t cover every aspect of every change, but we did hear that the actual form itself that you can go into ISO and print it off… You’ve been working from the circular.

Dustyne Bryant (38:01): I have.

Paul Martin (38:01): What they publish, but the form itself will come out in the next couple of months where if you have access through one of your carriers or directly through ISO, you’ll be able to go in there, download it, print it off, and you’ll have your own copy. But like I said, we thought it was a great opportunity this summer and something fun to do to let you know what is coming and show you that it’s not that big a deal. And there are some good changes in it. And then we have a brand new form that you might want to explore if you have clients that fit that demographic for that. Anyway, thanks for the review. I thought that was really good.

Dustyne Bryant (38:37): Thanks so much. It was so fun to talk about it. I love talking about policy coverage.

Paul Martin (38:42): That’s great. Well, again, the whole point was to help you feel more confident when you’re dealing with your customers and of course, confidence leads to sales success, and we know that. And we hope this will help.

Dustyne Bryant (38:53): Yes.

Paul Martin (38:54): So, Mitch, I want to turn it back to you.

Mitch Dunford (38:55): Thanks, Paul and Dustyne. We really appreciate it. Great, informative conversation and presentation. And a special thank you to you, our YouTube audience. Stayed tuned as we bring you more live events just like this in the near future. If you have a topic idea, don’t be afraid to email me your thoughts or your ideas at mdunford@scic.com. That’s mdunford@scic.com. If you’ve enjoyed this live stream, consider becoming a regular listener of our Awkward Insurance podcast hosted by Dustyne Bryant. I’m Mitch Dunford, thank you for tuning in, and we’ll see you next time.

About Our Speakers:

Dustyne Bryant, CIC, CISR, MBA, is the Personal Lines Academic Director at The National Alliance for Insurance Education & Research, and a self-professed and colleague-backed wholehearted Personal Lines Insurance geek. Supported by multiple degrees and designations over the course of a decade and rising, her thirst for knowledge is never-ending and ever-growing. Her passion for educating others in Personal Insurance is even greater. She is an advocate of permanency for children in foster care and relishes all the joys of being a soccer mom, minus the minivan.

Paul Martin, CPCU, is the Director of Academic Content and Academic Director Team Lead for the National Alliance for Insurance Education & Research. Paul works with Alliance faculty, agents, and other industry professionals to deliver high-quality insurance content and education. During his career, Paul worked as an adjuster, underwriter, special agent, company manager, and independent agent. Paul has been an insurance educator in Texas for over 20 years.