Picture the aftermath of a devastating natural disaster. Your client lost everything and now they have to deal with adjusters and a tedious claims process. Simultaneously, they are dealing with the urgency of immediate needs and out-of-pocket expenses like food and hotel. Imagine a world where you do not have to wait for a claim, the payout is sent within a few days, and there is no deductible. This is the reality with parametric insurance. What if you could provide your clients with protection to bridge the gap left by percentage deductibles, limitations, and exclusions in traditional policies (which only seem to keep growing), and eliminate claims paperwork?

Keep reading to learn about parametric insurance, how it functions, the protection gap all insured individuals face, and some existing solutions. You can also enroll in the revised CISR Other Personal Lines Solutions course, administered by The National Alliance for Insurance Education & Research, for more information about CAT coverages—including parametric coverage.

What is Parametric Insurance

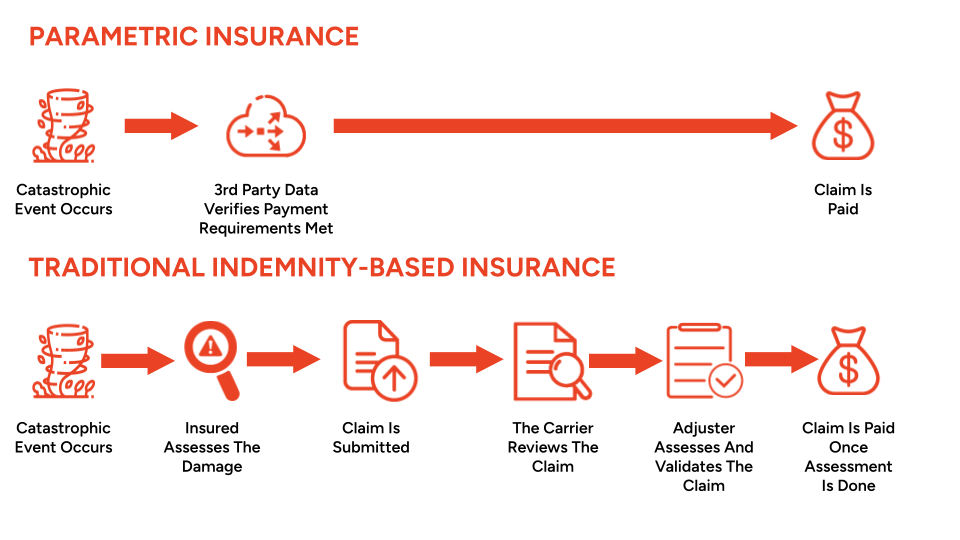

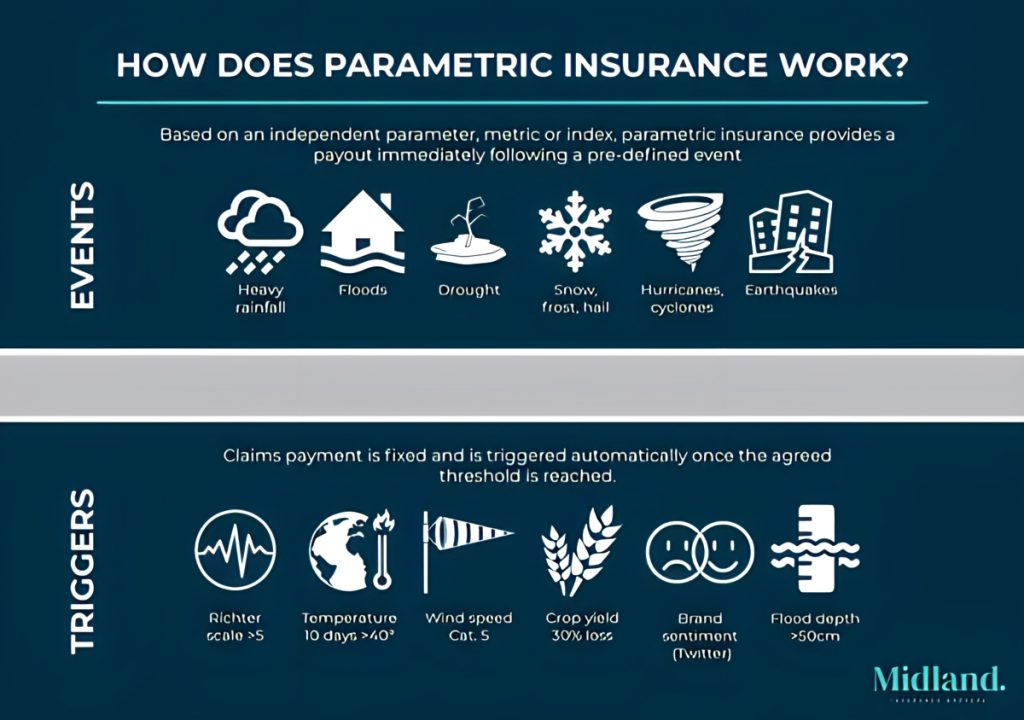

Parametric insurance is a data-driven insurance policy that pays out based on predetermined parameters, like wind speed or hail size, from verifiable third parties such as the National Oceanic Atmospheric Administration (NOAA).

The data-driven nature of the policy means payments are automatically triggered when the parameters associated with the policy are met. There is no need for additional documentation or human interpretation. By relying on factual data and eliminating the potential for disputes, parametric insurance ensures policyholders are compensated quickly without any hassle.

Furthermore, parametric policies have minimal overhead and offer a much more cost-effective way to acquire insurance, especially when covering gaps such as the deductible. Identifying which parametric insurance policies are correct for your client is essential. Basis risk exists when the payout does not match the exact value of the losses. The best approach is to select a company whose payout triggers or utilized data strongly correlates with the actual loss sustained.

What Triggers a Payment and What Risks Can it Cover

- Could you design a policy that triggers a payout if a power outage lasts a specific time? Yes.

- What about if a named storm occurs within a certain number of miles of the property, and the company’s revenue drops? Could they be insured based on how much revenue was lost?Yes.

- How about if a predetermined minimum amount of rain does not fall in a year over a specific farm? Could the farmer get a payout from lost crops due to lack of rain? Yes.

- What if Wimbledon was canceled due to a global pandemic? Could they buy a parametric policy that pays them out to compensate for the lost ticket sales revenue?Yes, and that is precisely what happened in 2020. Hopefully, some intelligent broker that sold that policy to Wimbledon received a bonus!

How Does it Work

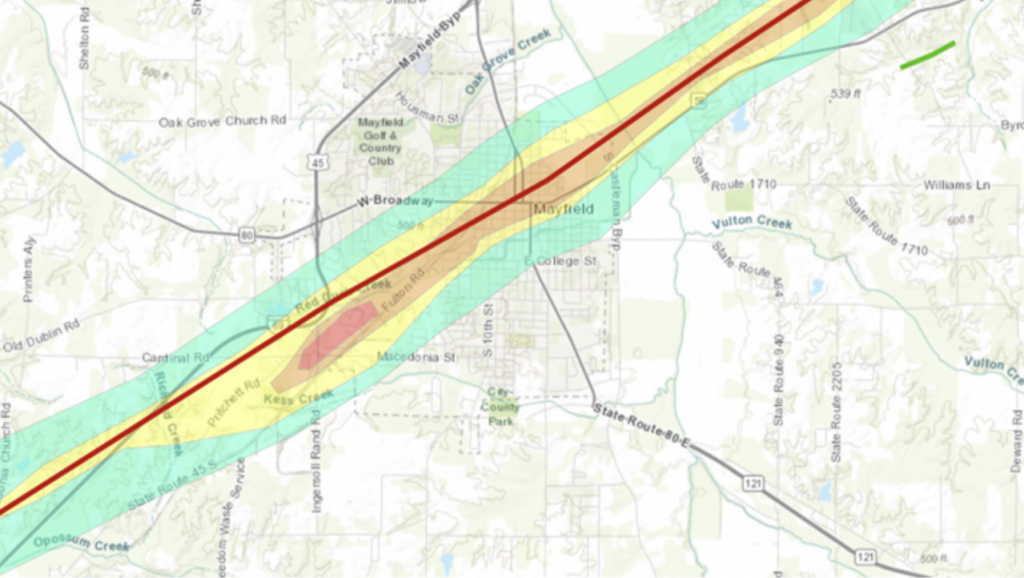

With parametric insurance products, preset payouts are issued to policyholders after a specific set of parameters are met. For example, Sola, a parametric natural disaster carrier, offers a product that pays out between $2,000 and $15,000 instantly after a homeowner is within an EF0 to EF5 tornado track as defined by the National Weather Service (NWS). Since data from the NWS takes only days to procure, payment will reach the insured much faster than traditional coverage.

The cited example represents just one illustration of a parametric trigger. The utilization of this type of insurance provides risk managers with the flexibility to craft customized triggers that align with their clients’ unique requirements and offer improved protection.

How Parametric Insurance Can Help Solve the Insurance Protection Gap

The Hardening Insurance Market

According to the Insurance Information Institute, homeowners insurance has increased faster than inflation, up 11.4% per year. Moreover, those rates are expected to remain high, as the cost of keeping a home insured has been affected by several factors.

Some primary factors for this rise in insurance rates are climate change, rising material costs, and supply shortages. Events like the winter freeze in Texas at the beginning of 2022 or Hurricane Ida, one of the top five costliest hurricanes in American history, have placed pressure on the reinsurance market, a vital tool for insurance companies to backstop their losses against climate change. Because insurance companies need to purchase reinsurance to maintain stability, the rising cost of reinsurance (i.e., the hardening reinsurance market) is also causing insurance companies to raise rates. Ultimately, it is a loop that only results in higher and higher rates due to more damaging climate events.

To handle this increased risk, insurance carriers push percentage deductibles to reduce smaller claims, mitigate expenses, and lower loss ratios. On the buyer side, homeowners and businesses increasingly opt for higher percentage-based deductibles in the event of wind or hail damage to save money on the yearly rate. Though if a natural disaster occurs, the amount paid out of pocket for damages is higher.

For example, a $500,000 home with a 2% wind/hail deductible would mean that the homeowner is responsible for paying out of pocket $10,000 if the damages have resulted from a wind or hail event. Ten years ago, the replacement cost of that home may have been slightly lower, but that homeowner would have probably been able to buy a policy with a more digestible flat deductible of only $1,000 for the same or lower premium. This phenomenon is happening to homes and businesses all over the country. Agents can now use parametric insurance to cover the first few thousand dollars to make up for these increased deductibles.

Some Examples in Action

Sola provides a supplemental add-on policy that helps homeowners and small businesses pay for their deductible and immediate expenses after a natural disaster. Their first product is a tornado-specific crisis coverage geared for the Midwest and Southeast U.S. It utilizes National Weather Service damage data to identify affected areas by severity and automatically pay out within a few days.

Flood Flash is an online parametric insurance company that offers commercial coverage in the US and UK in the event of a flood. The rapid payout is triggered once a flood of any kind reaches the pre-agreed trigger depth. They use sensors that are attached the sides of the insured’s building to determine this flood depth. Like other parametric insurance companies, they provide coverage for events excluded from traditional insurance, have no deductible, and the process is quick and hassle-free.

Zurich Construction has developed its weather parametric insurance to address the financial impact of weather delays on construction projects. Rather than requiring physical damage to trigger a claim, their payout comes from weather events with predetermined wind, rain, snow accumulation, cold, or heat thresholds. Zurich Construction acknowledges how these triggered events can delay a project and cause financial losses.

Unlike traditional earthquake insurance, which is intended to cover catastrophic costs, Jumpstart is designed to provide swift financial assistance in the aftermath of an earthquake. Jumpstart is supplied in California, Oregon, and Washington to supplement indemnity policies. Instead of waiting weeks or months for the claims process, Jumpstart will provide policyholders with a predetermined amount for residential or commercial policies.

So, Now What?

The coverage gap of home insurance caused by climate change is only getting wider. Still, with the emergence of parametric insurance, agents have an affordable and flexible solution to help clients fill in the missing pieces. In addition, parametric insurance offers an added advantage for agents looking for a reliable way to gain customer loyalty. From greater convenience and cost savings to replacement coverage in cases of natural disaster, this type of insurance has plenty of benefits that can help protect homeowners and their property. Offering parametric policies and giving customers more options for keeping their homes secure is a win-win situation. Plus, it just might be the deciding factor that makes your agency stand out from all the rest and solidifies your reputation as an agent your clients will love.

Meet the Author:

Wesley Pergament, Sola

Wesley Pergament, Sola

Wesley is CEO and Co-Founder of Sola Insurance based in Atlanta, GA. Wesley comes from a tech background and jumped into the insurance industry at a flood insurance startup where he was tasked with working on the data side with private and FEMA flood maps. Realizing this data was telling us exactly where the damage is, Wesley and the Sola team became obsessed with how data can be used to automatically trigger an insurance claim payout. Sola is starting with supplemental tornado coverage for homeowners and small businesses but plans to expand into every type of natural disaster to help people cover their deductible and immediate expenses. Sola has already been approved in 14 states as the first ever admitted personal lines parametric product, is fully reinsured through Lloyd’s of London and has partnered with dozens of agencies and aggregators.

Wesley Pergament, Sola

Wesley Pergament, Sola