The CSR Profile, first published in 1995, has become the essential reference for benchmarking data concerning the customer service personnel whose daily efforts on behalf of their agencies, companies, and clients are critical to the success of the insurance industry. In keeping with our commitment to conduct research that provides current information of practical benefit to independent agencies and other industry partners, the 5th edition of this book has recently been published.

One of the most noticeable changes to the 5th edition is a new name—The Pulse of Customer Service: A Profile of Insurance Industry Customer Service Personnel. This title was selected because job titles and customer servicing responsibilities at insurance agencies have changed significantly since the publication of the first edition. While the title of Customer Service Representative (CSR) is still widely used, other titles such as Account Executive and Account Manager are now more common, and these titles reflect the professional expectations that are attached to evolving job roles and titles at today’s agencies. The new title also underscores the fact that customer service personnel work in environments that pulse with activity—even on the slowest of days. Finally, and perhaps most importantly, customer service personnel have always been at the heart of the agency, and measuring the pulse of customer service provides critical insight into the overall health of the agency.

The other major change in the 5th edition is the addition of a section that presents insights and trends drawn from essays submitted by state and national winners of the 2017 Outstanding CSR of the Year® Award competition. The essays were written in response to the question, “A friend who is a CSR has come to you for advice about a new customer service job opportunity in an agency in another city. What five factors about the employer and the position would you advise them to consider before

accepting the job?”

Tabulating the factors that were cited in these essays yielded a more focused analysis drawn from a smaller, and largely younger, subset of customer service professionals.

The foundational elements of the study have remained the same. The raw data was derived from surveys submitted by customer service personnel, the results were tabulated separately for commercial lines and personal lines personnel, and the benchmarking data and discussion focuses on the eight major areas of concentration that have been presented in the prior studies. This continuity makes it possible to recognize key trends over time in each of the following areas:

• Characteristics

• Hiring and Qualifications

• Professional Development

• Responsibilities

• Compensation

• Servicing Volume

• Comparison of CL and PL Account Managers/CSRs

• Trends from Prior Studies

Like its predecessors, the 5th edition also includes practical tools. There are checklists that agency owners and managers can use to compare their agencies’ data with national benchmarks, or service personnel can use to compare themselves with their colleagues. And there are job description templates for use in employee recruiting and hiring.

From an industry perspective, the responsibilities and performance standards attached to customer service positions continue to increase. Moreover, client retention often depends on fulfilling the agency’s promise to provide excellent customer service. So, who are the professionals who are delivering on that promise? Let’s take a look at some of the survey results concerning the characteristics of customer service personnel.

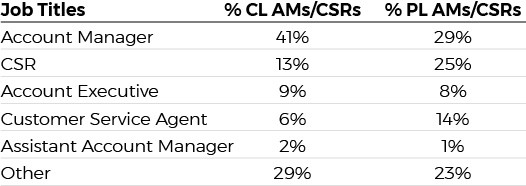

Job Titles

The following table identifies the titles most often held by the customer service personnel at the heart of today’s agencies.

While the table shows that the job title of Customer Service Representative has been superseded by the title of Account Manager, CSR remains the second most popular choice at both PL and CL agencies. It is also important to note that the table includes the category “other.” This category is fully detailed in the sections of the publication that deal separately with CL and PL personnel.

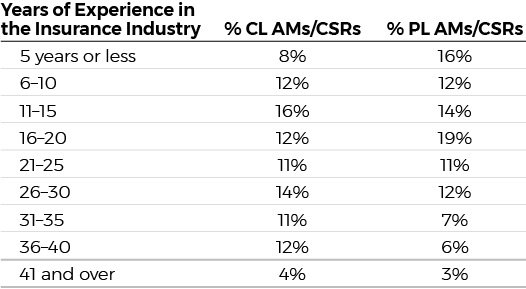

Experience—Years in the Insurance Industry

As the following table shows, significant percentages of the survey respondents are highly experienced customer service personnel:

64% of the CL Account Managers/CSRs and 58% of the PL service personnel have been in the industry for more than 15 years. A large number of National Alliance designees responded to the survey, so the high level of industry experience is not surprising. What is noteworthy is how agency owners, managers, and supervisors can use the experience factor to extrapolate additional insights that are not presented in the survey findings.

For example, when highly experienced customer service personnel report that the most important servicing skill that they would like to improve is effective questioning, it can also be concluded that less experienced personnel — whether or not they identify this need — would also benefit from training in effective questioning. While experienced personnel often deal with larger and more complex accounts that require more refined questioning skills, the ability to effectively query clients is important for all customer service personnel.

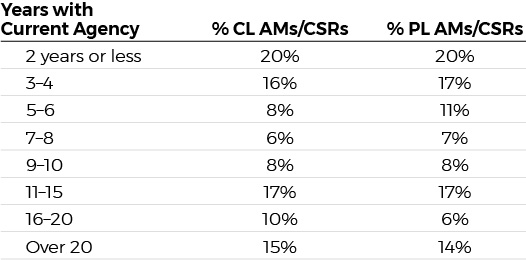

Time with the Current Agency

In the original 1995 study, the data revealed that customer service personnel demonstrated exceptional loyalty to their current employers, a statistical finding that contradicted the industry misconception that customer service personnel frequently changed employers. The 2018 study reconfirms that this attribute remains a hallmark of customer service personnel.

The survey results show that Account Managers/CSRs respond positively to growth opportunities within their agencies, a significant factor in employee retention. As the following table indicates, only 20% of PL and CL customer service personnel have been employed by their current agencies for less than two years, while 37%–42% have worked at their agencies for more than ten years. Even more impressive is the 14–15% of the survey respondents who have been with the same agencies for more than 20 years.

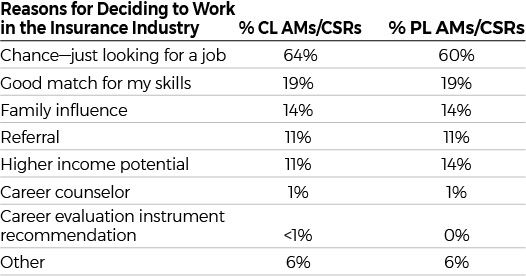

These figures are particularly impressive when you consider that 64% of CL Account Managers and 60% of their PL counterparts arrived in the industry entirely by chance. That so many individuals would stay in the industry by choice speaks well of the industry, the agency environment, and the individuals who hold these positions.

Additional data concerning the characteristics of customer service personnel includes demographic information such as age, gender, agency size, and location. The other major sections of the publication present statistical information and analysis of the data related to hiring and qualifications, professional development, job responsibilities, compensation, and servicing volume. In addition, trends from prior studies are compared with the 2018 data, and a comparison of key benchmarking data for PL and CL customer service personnel is included.

The National Alliance would like to thank the 1,221 individuals who participated in the survey, as well as the state and national winners who submitted essays for the 2017 Outstanding CSR of the Year® Award competition. All of these individuals are a credit to the industry—and we have the numbers to prove it.