Bill Toll, CIC

Too many agency owners and managers, producer compensation resembles a basket of snakes. It is not particularly pretty, it is constantly moving, and if you are not careful, it is likely to bite you, with disastrous results.

As with all things, careful planning can assist with managing the basket of snakes. So let’s begin with the three basic goals of producer compensation. The first is to provide growth to the agency. There is no reason to hire a producer into the agency unless the producer is going to work to assist with overall agency growth.

The second goal is to provide for agency profit. If a producer is hired, you would not expect that person to be a drain on the assets of the agency over the long run. Every producer should add to the profitability of the agency by producing business with generally low loss ratios and clients who will stay with the agency over a number of years. Generally, it takes about three years for an agency to realize some profit from a new producer with no existing book of business. This leads us to the third goal.

The third goal of producer compensation is to attract and retain good producers. This goal is closely tied to the other two producer compensation goals because an agency wants to retain producers who provide growth and produce profitable business. Producers of this caliber can be candidates for managerial duties and future perpetuators of the agency. Agency owners can often construct tailored buyout structures with existing agency producers whose capabilities are known and valued, as opposed to selling the agency to a third party at some point in time. The buyout structures can be built with individual components beneficial not only to the agency owner(s), but also to the producer(s).

With these three goals in mind, it is possible to take a deeper look at the individual design elements. There are two major parts to producer compensation, with the “up-front” consideration being any salary and/or commission share the agency might pay to a producer. The second part is the “outback” part of the equation, and consists of equity, which is defined as some form of ownership in the business produced, and perhaps, ultimately the agency itself.

Every producer needs equity or some ownership in the business they produce. Every person, including producers, thinks about what things will be like in the future, not only for themselves, but also for any dependents the producer may have. The primary question is, “What am I going to retire on?” If an agency does not satisfy this need, then the producer might move to another agency where their equity need is more likely to be fulfilled. As a result, the agency the producer leaves will lose the investment it has made in developing and training the producer.

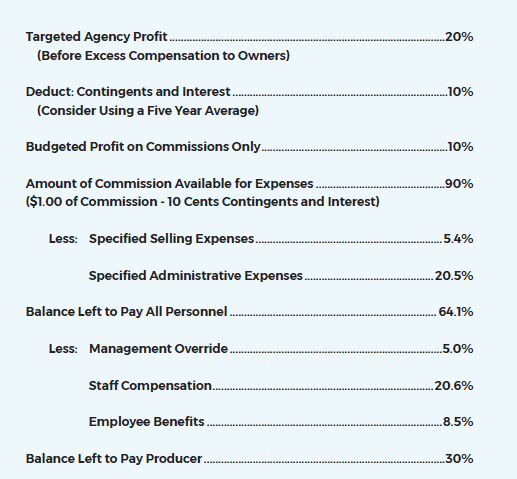

If we consider the up-front portion of producer compensation first, then we can focus on the first two producer compensation goals. In the example table on this page, we can consider the profit goal first. Agency owners should pay themselves first; the rate of return an agency and its owner(s) wants can range widely: for example, from 12% to 20% or even 25%. In the chart, 20% has been selected as a targeted pre-tax profit. If we think of a dollar of commission coming into the agency, 20 cents of it would go into the pockets of the owner(s) first. Owners should think of the concept of paying themselves first as being compensated for the business risk they are taking.

After the 20% (or whatever rate of return the agency wants is established), the contingent commissions and interest income should be considered. Right now, interest rates are very low, but insurance companies are continuing to pay their agents bonus/contingent commissions for writing profitable business. Agencies that write profitable business and hire producers who do the same can qualify for bonus/contingent commission. This agency income is particularly valuable because there is very little or no expense attached to it and it drops to the bottom-line profit.

For this reason, bonus/contingent commissions can be deducted from the targeted agency profit. In the example, we have a targeted profit of 20%, and if we have contingent (and/or bonus income) and interest income equal to 10%t of the commission dollars coming into the agency, then the agency has earned half of the targeted agency profit of 20% from writing profitable business. Therefore, the agency only has to realize a 10% profit after the adjustment for contingent/bonus commission on every dollar of commission coming into the agency.

Typical Well-Run Agency

In the example, if we have an adjusted targeted agency profit of 10percent, and we subtract it from the one dollar of agency commission, we have 90 cents of the commission dollar to apply to agency expenses. If we assume that selling expenses outside of commissions to producers averages about 5.4% (this can vary from one agency to another), and we assume fixed administrative expenses at an average of 20.5%, that leaves us with 64.1% of our one dollar of commission to pay all agency personnel.

In the example, the first item in paying personnel is management override. This is a payment to the owner(s) of the agency for time spent in strategic and operational management, planning, and decision-making. The standard percentage assigned to this payment is five percent of the commission dollar coming to the agency. If there are multiple owners in the organization, this does not mean each owner gets five percent, but rather, five percent is split among the owners with the owner(s) spending the most time in management getting the largest share of that five percent.

Staff compensation is paid to the account managers/customer service representatives who represent the backbone of the agency; typically, this is about 20.6% of the commission dollar. A related item is employee benefits, such as health insurance for all personnel, including owners and producers. These expenses average 8.5%, depending on the state where the agency is located. In the example, after deducting staff compensation and benefits, the balance left over to pay a producer is only 30%.

It is very likely an agency would not be able to find a producer who would work for an agency for 30% of the agency’s commission across the board. A much more typical split for a commercial lines producer is 45% to 50% on new business and 25% to 30% on renewal business. For personal lines, it is typical to see 50% to 70% on new business and up to 10% on renewal, especially for direct-billed business. Paying more for new business than for renewal business emphasizes new business production and satisfies the producer compensation goal of providing growth for the agency.

Then what does the 30% left to pay the producer actually mean? If, for example, an agency pays 50% of new commercial production to a commercial producer, it is easy to see there is no targeted agency profit in the first year. The 20% targeted agency profit is added to the 30% percent of the commission dollar to achieve 50%; however, the 10% from contingents, bonuses, and interest would still be available, as long as business is profitable. The idea is to achieve the 30% of the commission dollar on the average by paying more of the agency commission for new business and less on renewal business. As long as the 30% is achieved, the goal of providing a profit for the agency is realized. The idea is to achieve the 30 percent of the commission dollar on the average, by paying more of the agency commission for new business and less on renewal business. As long as the 30 percent is achieved, the goal of providing a profit for the agency is realized.

But that leaves the outback portion of producer compensation. How can the agency satisfy the equity needs of a producer while simultaneously satisfying the third goal of producer compensation: retaining good producers? There are several ways an agency can look at structuring the transfer of agency equity, but the important point is that equity (ownership) in an agency should be earned. Most likely, the current owner(s) of the agency did not receive ownership as a gift and is, therefore, reluctant to give it to others.

An agency hiring a new commercial producer with little or no existing book of business could establish a honeymoon period that would last about three years. During this period, the agency owners would learn more about the producer’s work habits and interactions with other agency and company staff. After the three-year period concludes, a decision would be made regarding the producer’s eligibility to be granted ownership in the business the producer has produced. If the decision is to grant ownership, the granting could be done at 10%per year until a certain level is reached, such as 50% or 60% or more. Then the percent granted in the business the producer has produced could be used as a down payment toward stock purchase. A transaction such as this needs careful planning and should be done only using the professional counsel of accountants and tax experts.

By keeping the three goals of producer compensation in mind: (1) provide for agency growth, (2) provide for agency profit, and (3) attract and retain good producers, the agency can make progress in charming the producer compensation basket of snakes.

Learn More. Earn More.

The Research Academy has periodically published Insurance Producer Profile: Compensation, Production and Responsibilities which will provide guidelines to help agency owners and managers with this very important topic.

About the Author: William C. Toll, CIC

Bill Toll has worked with The National Alliance in several capacities since 1986. In addition to his work with The National Alliance Research Academy and as the new Editor of Resources Magazine, he is a National Faculty member and Educational Consultant for both classroom and online courses.