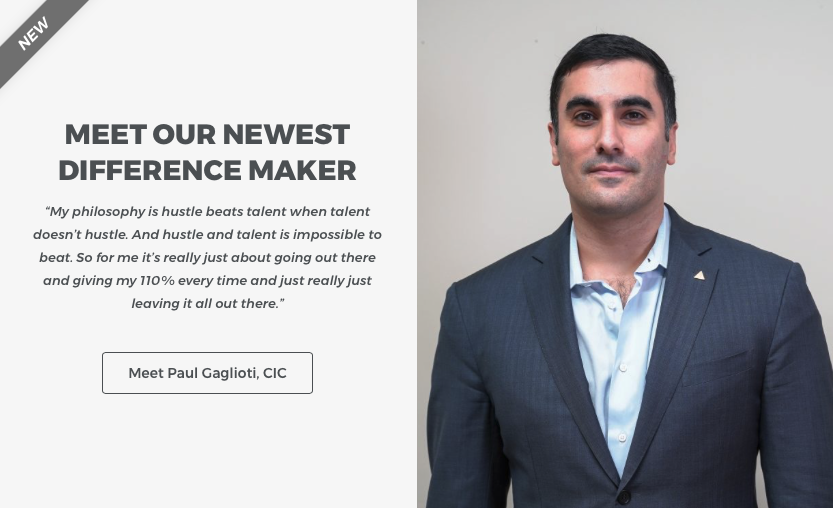

In this interview Mitch Dunford speaks with Paul Gaglioti, CIC, President of Diversified Risk Solutions and CEO of Harbor.ai. Learn how Paul began in the industry, and the steps he took to advance his career.

As one of The National Alliance’s Difference Makers, Paul’s advice is particularly valuable for those who are new to the industry. And if you’re a seasoned professional it may remind you of the ‘good ole days’ when you were a beginner yourself!

Diversified Risk Solutions is a retail brokerage I started nine years ago. We focus largely on commercial lines, writing all types of business – primarily E&S and specialty lines. The other company, Harbor.ai, is a technology platform and insurance exchange. Basically we help brokers to secure commercial lines products from some of the world’s finest insurers in the most efficient way possible. Actually, Plug and Play, one of the premier insurance accelerators in the world, named us their top insurtech startup in the summer class.

I always liked to learn and was a very curious, hands-on, problem solving type of guy. But high school was just not the environment to nurture my education. I’ve also always liked to work. The importance of a good work ethic and respect was instilled in me at a very young age. High school was mostly going through the motions, although I did well on standardized tests.

What I didn’t do well was homework. And I worked a lot all through high school. The University of Arizona was a great experience, but I spent far more time at the pool than in the classroom – the desert will do that to you – but I learned a lot all through college. I worked at Merrill Lynch in New York City. So during those years I learned about myself and what I could do.

I was supposed to graduate around 2008, but after the financial crisis I realized it wasn’t going to be the best time to go into finance. I worked in a dry-cleaning business in Arizona, but that business failed within four or five months. So I went home to New Jersey and got an opportunity to work in the real estate business. Then I got into insurance and the rest is history.

When I started Diversified Risk, I was a 25-year-old kid working out of my parents’ house. I had eight months insurance experience and I knew nothing. My dad was a very successful salesman and he said I needed to know more than my competitors and to be well-versed. I didn’t even know what CIC stood for at the time, but I knew that the people who were CIC’s were smart.

That was obviously before any of the remote courses, and the in-person class was just sort of overwhelming in the beginning. But at some point you have to pull the band-aid off and just go and do it – and you’re in this room with these brilliant people who just love insurance and it’s infectious. They teach you about it. So it was unbelievable. And after that I went through systematically class by class. I learned so much – and the educators are the best part. I don’t remember many of their names, but I remember what they taught.

I think it should be mandatory, frankly. I mean, every CIC I’ve ever met is very well versed in insurance and they have such a high level of experience. It’s unbelievable. Now I’m a little more removed from retail sales – I’m mostly dealing with brokers. So when I’m talking to a commercial launch prospect for Harbor.ai, there’s a commonality of knowing that this person knows their stuff. That’s why we’re giving benefits to people with CIC and CRM level designations. We know they’ll do more with the opportunity and we’ll have less problems to deal with. The CIC designation is very near and dear to my heart.

Life and Health. The liability and property related stuff is great. Agency management is great. But for any P&C broker in general, even if they’re not going to get the designation, taking the CIC Life & Health course gives them a context about a whole other layer of our industry. I remember one of the faculty members in particular. The way he described the products was so intimate. And he knew so much and couldn’t tell you enough about it in the time we had. It will always really be something I can’t forget, to be honest.

I have. And I recommend it – because insurance salespeople are the best salespeople in the world. It’s the truth. We don’t give ourselves enough credit in the industry. I hear people all the time. Well, my friend is a mortgage broker. They’re the best salesperson. My friend’s a car salesperson, and they’re the best. But our salespeople are the ones who help people when their house burns down – you know – the corner insurance broker. And a lot of times we provide another level of care, which is someone to talk to when it’s really bad time.

There is a science to selling. Having a consultative and helpful approach is so important while you’re diagnosing what the risk exposures are. But at the same time, you have to understand the uniqueness of insureds and their needs. Dynamics of Selling is an unbelievable value to anybody – even to those that don’t sell insurance products. There’s value in underwriters and those who are removed from sales starting to understand what retail brokers go through when they’re dealing with insureds. The value is not just the actual sales, but understanding the nuances of the insurance sales process.

In the context of being an insurance professional, we have so much impact on the world that level of integrity is ingrained in everything we do. You have a license and you’re providing products and helping people. We want to basically be a sounding board, a trusted advisor to help people. So when it comes to education, the number one thing that’s true at home is that ethics is critical.

It’s like when you go through any of the programs from The National Alliance. Even if you don’t pass the test, you just sit through those classes and you’ve elevated yourself. At its core, the classes and the educational component gives you a way to understand policy language. No one is going to understand every form. It’s impossible. They change too often. But you learn how they all relate to one another and how it matters when you explain them to somebody.

It goes back to why insurance salespeople are the best salespeople in the world. You have to take this extremely complicated concept and dilute it down to put it in simple terms. I frankly don’t know how I would ever have been able to do that without being able to leverage the education that came with my CIC.

The first thing I would do is look to The National Alliance for entry level classes. Maybe CIC is a lot in the beginning. By no means are those classes easy because you’re getting top level instruction and education at the cutting edge. But there are other National Alliance programs that are incredibly valuable.

Another thing I’d tell people is the beauty of today’s world is you have things like LinkedIn. Go take a look and you’re going to find that a disproportionate amount of people in decision making roles have National Alliance designations. Talk to those folks about what they believe in and what they think you should do.

By taking these classes you know that the way you talk to people in industry is going to be better. The way you look at products is going to be better. I think that anybody in the industry can benefit from the education and The National Alliance makes it so easy. You can take classes online.

The other thing I’ll tell people is that I’ve made more connections and gotten more appointments with carriers, and the networking is valuable. And when The National Alliance puts these events on they’re well thought out because insurance professionals put it together. It isn’t a third party. It’s people who are truly dedicated to the craft of teaching insurance and bringing our industry further.

So I’d start with The National Alliance. If you want, you can bite off more than you can chew and take a CIC class. I highly recommend that too. Even if you don’t pass, you’re still going to gain an unbelievable amount of information. And of course the CE credit. I look forward to my updates. I’m always looking to see what I want to go to, whether it’s a Ruble seminar or something else. There’s so much great content, and I really appreciate it.