The process of underwriting involves a person or organization accepting financial risk in exchange for compensation. Most frequently, this risk entails loans, insurance, or investments. The practice of having each risk-taker place their name under the amount of risk they were willing to undertake for a certain premium gave rise to the term “underwriter.” Despite changes in the mechanics over time, underwriting remains a crucial task in the insurance industry today.

What does an insurance underwriter do?

Insurance underwriters are insurance professionals who understand insurance risks and how to avoid them. They assess the risk of insuring homes, cars, drivers, and individuals who apply for life insurance policies. Insurance underwriters establish the types of policies applicants are eligible for and provide coverage outlines for their unique circumstances.

Why do we need underwriting?

The underwriting function exists to ensure that a carrier is writing business that fits the company’s risk appetite, which is determined during strategic planning. The product development department creates programs based upon this appetite and embeds rules and guidelines within the programs to support the selection of risks.

How is underwriting conducted?

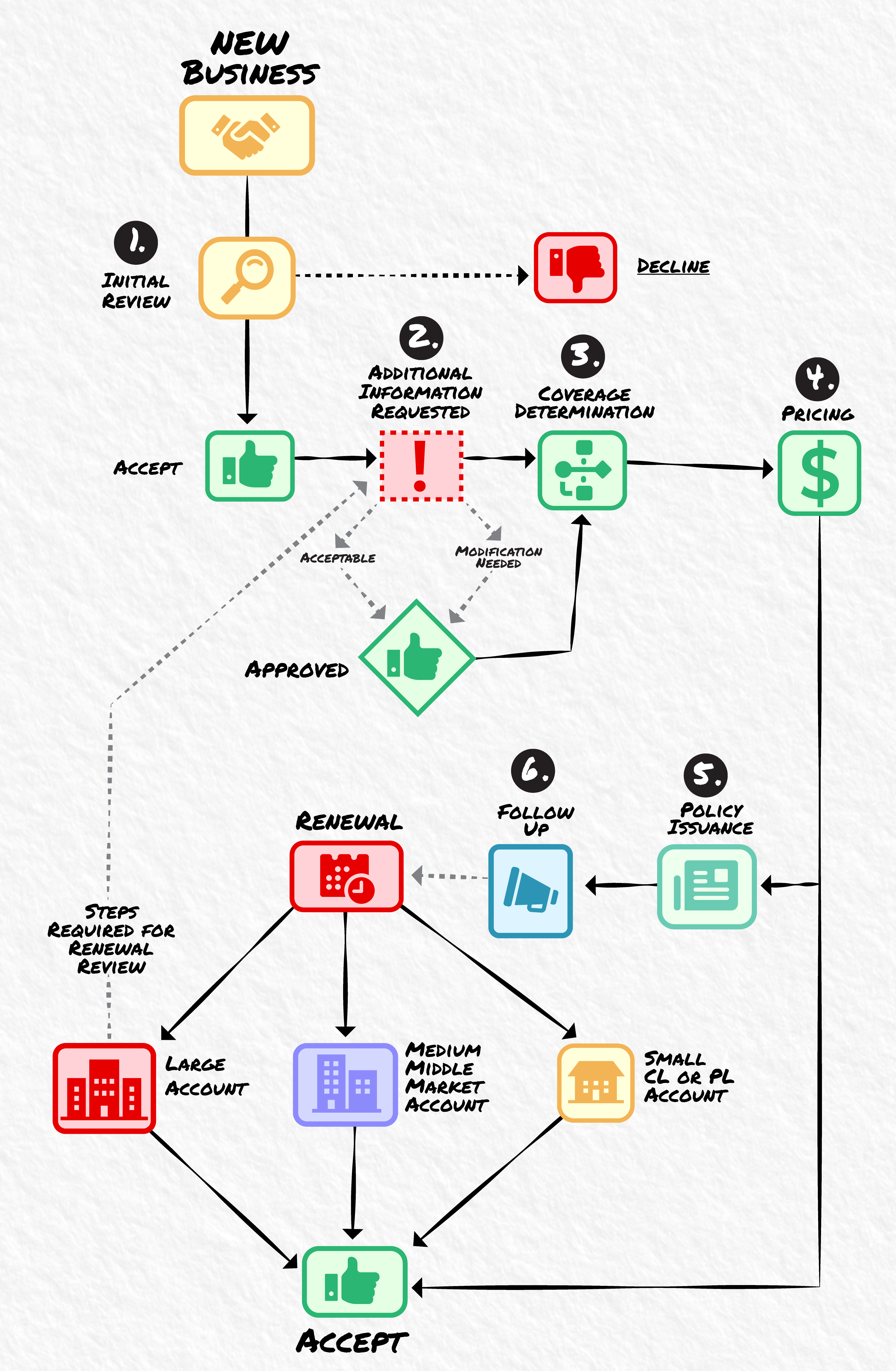

Companies write business in many ways. Some carriers choose to be generalists and offer a broad array of products over a large spectrum of risk classifications. Others choose to take a much narrower specialist approach and target specific market segments. The distribution force is responsible for selling products to consumers and collecting all the information a company needs to underwrite the business properly. The information is then submitted to the carrier’s underwriting department for evaluation. This is where the six steps of the underwriting process kick in.

Step 1: Initial Review

Underwriters make an initial review of an insurance application and supporting documents to determine the acceptability of a submission. Standardized ACORD applications are acceptable for most lines of business. However, some companies may require proprietary supplemental applications to gain a more complete picture of the characteristics of certain risks.

If a risk does not meet a company’s guidelines, the underwriter will decline the submission. If a submission is within the company’s risk appetite, the underwriter will begin a deeper analysis of the risk to determine if it is acceptable as-is or if modification is needed.

Step 2: Additional Information Request

Next, an underwriter will determine what additional information is required to assess a risk. Some submissions may contain detailed information, including loss runs, pictures, and narratives. In such instances, thorough underwriting can be done immediately.

Incomplete submissions cause delays but are not the only resource needed to complete the underwriting process. If a submission is less complete, an underwriter will request the necessary external information from the agent. Underwriters may order credit reports, loss control inspections, motor vehicle reports (MVRs), and comprehensive loss underwriting exchange (CLUE) reports to help with the risk assessment and decision process.

The ACORD© Forms Training Course can help agents submit acceptable applications.

Learn MoreStep 3: Coverage Determination

If a risk meets the company’s designated criteria as submitted, the underwriter will approve the submission and move to the rating process. Sometimes marginal submissions are acceptable if coverage modifications are made. The underwriter may suggest deductible options, limits options, limitation endorsements, or other modifications that make the risk acceptable. If the risk does not fit the desired profile and cannot be modified, the underwriter must decline the risk.

Step 4: Pricing

Once coverage determinations are made, the next step in underwriting is to set the account’s pricing. Some lines of coverage allow certain levels of discretionary pricing. Discretionary pricing refers to the ability of an individual underwriter to credit or debit an account or a portion of an account based on the merits of the risk, program, or agency segmentation. Another form of discretionary pricing is using standard versus preferred programs within a company.

Standard company products may be written at manual or prescribed pricing, while the preferred program already includes a credit. Agency stratification or segmentation presents another opportunity to provide credit. Many carriers have identified high-performing agents and brokers based on profitability, growth, and retention. These agents and brokers thus become eligible for additional credit consideration in recognition of their preferred status. Commodity lines such as private passenger automobile or homeowners’ insurance are usually class-rated with no deviations allowed. There is no subjectivity involved as these lines are heavily regulated.

Step 5: Policy Issuance

After an agent receives a quote and the insured purchases coverage, policies must be issued. The company is required to deliver the policy to the insured in most cases. These policies are either delivered electronically or mailed to the insured with a copy to the agent. Certain regulators may not allow policies to be delivered electronically.

Step 6: Follow-Up

In some cases, policies are written subject to certain conditions and require follow-up. These could include, for example, receipt of additional information or compliance with loss control recommendations.

In conclusion, insurance underwriters execute two critical functions: reviewing new business and renewing business, including proper risk selection, appropriate pricing, and maintenance of the company’s risk appetite. The underwriting department safeguards the strategic plan and targets the business segments determined during the strategic management process.

To learn more about the underwriting process and how it fits into operations, register for an upcoming CIC Insurance Company Operations course.